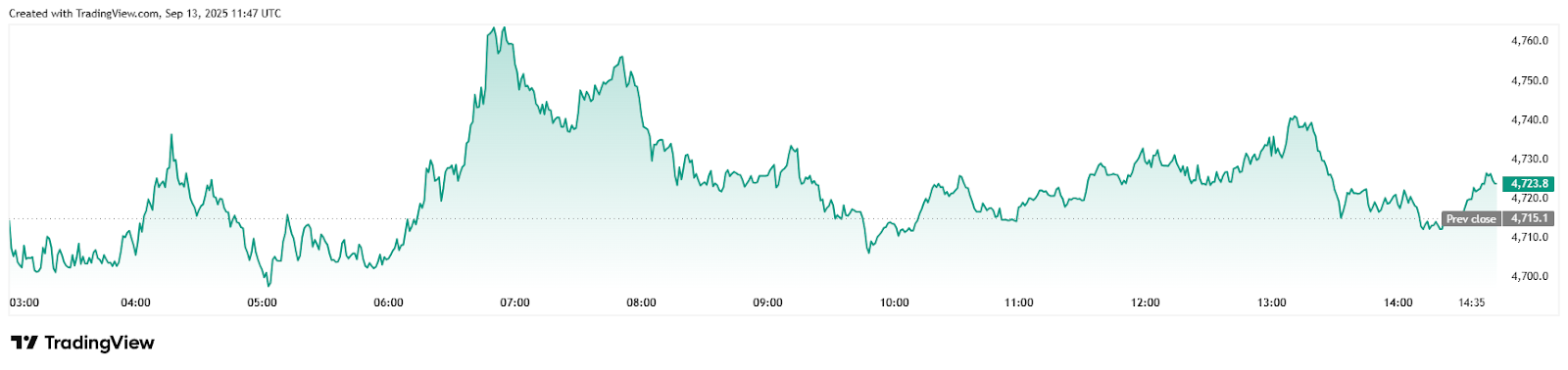

Ethereum (ETH) has been on a steady climb, recently pushing toward the $4,700 mark after weeks of bullish momentum. Institutional inflows have been pouring into Ethereum ETFs, surpassing $4 billion, and many analysts see the token primed to test the $5,000 level if it breaks resistance. The market’s second-largest asset is cementing itself as the backbone of decentralized finance (DeFi) and Web3 adoption, with developers and enterprises alike continuing to build on its blockchain.

Yet even as Ethereum’s outlook strengthens, questions remain about the size of its potential returns. With such a high market capitalization and broad adoption, ETH is expected to deliver steady growth, but not the explosive multiples of its early years. This is why analysts are pointing to an earlier-stage contender, Mutuum Finance (MUTM), as a token capable of delivering outsized ROI for investors willing to act before its official launch.

Ethereum (ETH) and its ROI ceiling

There’s no denying Ethereum’s dominance. As the most widely used smart contract platform, it powers much of today’s DeFi infrastructure, NFT ecosystems, and enterprise blockchain applications. ETH holders also benefit from staking, which has introduced yield-earning opportunities while reinforcing network security.

With ETH trading around $4,700–$4,720, the near-term target of $5,000 looks realistic, and some forecasts push as high as $7,000 in an extended rally. That represents a gain of 10–50% from current levels — solid returns for a large-cap asset, but modest compared to the potential of smaller projects entering the market at the ground floor. For ROI hunters, Ethereum is the “safe choice,” but not necessarily the place to find exponential growth.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is a decentralized lending and borrowing protocol currently in presale. Unlike many early tokens that rely purely on hype, Mutuum Finance has been designed with core DeFi mechanics. Mutuum Finance introduces a dual-lending market system, combining protocol-to-contract (P2C) liquidity with pooled peer-to-peer (P2P) dynamics. Borrowing costs fall when liquidity is abundant, encouraging usage, while interest rates rise when liquidity tightens, attracting deposits and repayments. This creates a self-balancing system that keeps assets in motion and drives activity. Borrowers also have the option to lock in stable rates, providing predictability in volatile conditions — a feature that appeals to more cautious users.

The project has already raised more than $15.75 million, drawn in over 16,280 holders, and sold around 710 million tokens. It is currently in Phase 6 of its presale, priced at $0.035, with the next stage set to push the price to $0.040 before reaching $0.06 at launch. Early participants who entered during Phase 1 are already sitting on gains of more than 350%, a clear signal of how quickly momentum has been building. This presale model alone creates built-in appreciation, but it’s the protocol’s features and how they tie directly to demand for MUTM, that have analysts calling it one of the most compelling new opportunities.

On the depositor side, participants receive mtTokens, which accrue yield in real time while remaining liquid. These tokens can be transferred or even deployed in other DeFi protocols without losing the underlying yield, a feature designed to maximize capital efficiency and user retention. Layered on top is the buy-and-distribute mechanism, where a portion of protocol fees is used to buy MUTM tokens on the open market and circulate them back into the ecosystem. This creates constant buy-side pressure, structurally supporting the token’s price over time as adoption grows.

ETH vs MUTM

The contrast between Ethereum and Mutuum Finance becomes clear with a simple scenario. A $1,000 investment in ETH today at around $4,700 would secure just under 0.22 ETH. If Ethereum rises to $5,000 over the next year, that position would be worth roughly $1,100, a modest gain, but not the kind of transformative growth many investors are looking for.

By comparison, a $1,000 presale entry into Mutuum Finance (MUTM) at $0.035 would already be worth around $1,715 at launch when the token lists at $0.06. When post-launch adoption drives the price into the $0.15–$0.30 range, that same stake could rise to between $4,200 and $8,500. Looking further ahead, long-term catalysts outlined in the project’s roadmap have analysts predicting MUTM in the $1.35–$1.50 range by 2026, where the initial $1,000 position could surge to more than $38,000. This ROI math highlights why ETH is seen as steady, while MUTM is capturing attention for its asymmetric upside potential.

Stablecoin integration & Oracle infrastructure

One of the biggest catalysts in Mutuum Finance’s roadmap is the introduction of an overcollateralized stablecoin. Stablecoins are the lifeblood of decentralized finance, enabling seamless borrowing, lending, and trading flows. By backing its stablecoin with excess collateral, Mutuum Finance ensures solvency even during volatility, while keeping liquidity circulating inside its money markets. This design not only deepens protocol activity but also generates recurring fee streams that feed directly into the buy-and-distribute model, creating continuous buy pressure for MUTM. As stablecoin adoption grows, so too does the demand for the underlying MUTM token, tying long-term stability directly to token appreciation.

Supporting this ecosystem is a robust oracle infrastructure. Mutuum Finance plans to rely on Chainlink price feeds, widely regarded as the industry standard for secure and decentralized market data. These oracles will deliver real-time price updates critical for fair collateralization and liquidations. The design also anticipates fallback oracles to maintain resilience in case of disruptions, along with the potential use of aggregated or on-chain metrics like time-weighted average prices for extra safeguards. This multi-layered approach ensures that the system can withstand shocks, reduce manipulation risks, and inspire confidence among institutional and retail participants alike.

Together, the stablecoin and oracle components position Mutuum Finance as a protocol built for scale and sustainability. By anchoring liquidity through a trusted stable asset and ensuring precision in pricing and risk management, MUTM is laying the groundwork for long-term adoption and with it, the potential for exponential growth.

The case for acting early

Ethereum’s momentum is undeniable. With institutional inflows and strong fundamentals, ETH remains a cornerstone of any crypto portfolio. But for investors hunting exponential ROI, the biggest multiples are often found in earlier-stage tokens where adoption is just beginning.

Mutuum Finance has already raised more than $15.75 million, attracted over 16,280 holders, and locked in structural mechanics that support demand from the first day of trading. With Phase 6 priced at $0.035 and selling out quickly, the presale will soon move to $0.040 before launching at $0.06, effectively giving today’s buyers nearly 2x gains locked in before the broader market even has access. For investors weighing where to put capital today, the choice is becoming clearer: Ethereum offers stability and institutional strength, but Mutuum Finance offers the kind of early entry that has historically created the largest returns in crypto.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER – “Views Expressed Disclaimer – The information provided in this content is intended for general informational purposes only and should not be considered financial, investment, legal, tax, or health advice, nor relied upon as a substitute for professional guidance tailored to your personal circumstances. The opinions expressed are solely those of the author and do not necessarily represent the views of any other individual, organization, agency, employer, or company, including NEO CYMED PUBLISHING LIMITED (operating under the name Cyprus-Mail).

Click here to change your cookie preferences