The global semiconductor market delivered a record-breaking performance in the third quarter of 2025, according to market intelligence firm Omdia, with industry revenue reaching $216.3 billion to mark the first time the sector has exceeded the $200 billion milestone in a single three-month period.

This 14.5 per cent quarter-over-quarter increase followed an already robust second quarter which saw 8 per cent growth, placing the industry on a definitive trajectory to exceed $800 billion in total revenue for the full year of 2025.

The performance recorded in the third quarter of 2025 far exceeded seasonal expectations, as historically this period sees an average increase of just over 7 per cent while public guidance had suggested roughly 5 per cent growth.

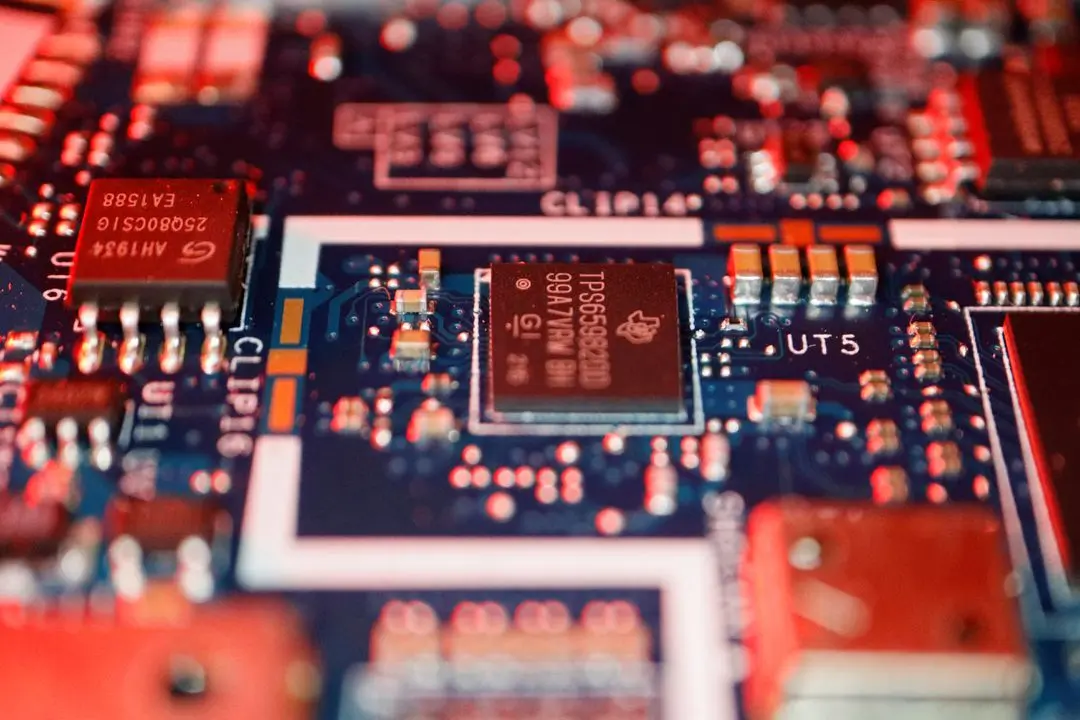

While Artificial Intelligence and memory products remain the primary engines of expansion and continue to outpace the wider market, the analysts noted that a broader range of segments contributed to growth during this period than in previous quarters.

The industry has seen a shift from the uneven expansion of 2024, a year where the market grew by more than 20 per cent but was constrained by soft demand in areas outside of NVIDIA and memory integrated circuits.

In contrast, 2025 has demonstrated a healthier and more broad-based recovery, evidenced by the fact that even when the dominant players are excluded, the rest of the market grew by over 9 per cent in the third quarter.

For the full year of 2025, total revenue is projected to rise nearly 20 per cent from the previous year, with the broader market on track for roughly 9 per cent annual growth to confirm a shift toward industry-wide expansion.

The top four semiconductor companies by revenue in the third quarter were NVIDIA and the three major memory manufacturers, Samsung, SK Hynix, and Micron, which together accounted for over 40 per cent of all semiconductor revenue.

“Demand for conventional DRAM is surging alongside HBM as AI inference workloads scale, driving an exceptional short-term price rally,” said Senior Principal Analyst Lino Jeng.

The analyst further explained that the market expects the fourth quarter to set another all-time revenue record, with this extraordinary strength likely to continue well into next year.

This surge highlights the continued dominance of AI accelerators and advanced memory components which remain critical to the global technological infrastructure.

Click here to change your cookie preferences