The Turkish lira, at 10.32 to the euro, 8.44 to the dollar at this writing, is under extreme stress, according to analysts.

The currency is perilously close to its record low of 10.50 against the euro, 8.58 to the dollar.

Turkish inflation data due next week will test the lira and with oil elevated and the currency weak since the last inflation release, the probability of higher inflation is a potential trigger for another lira sell-off.

Inflation was 17.14 per cent in April and the lira has slipped since the May 3 inflation release.

Meanwhile, oil has risen to near its 2021 peak and iron ore, which Turkey imports in large amounts, hit a record high. This risks pushing up the general inflation figure in Turkey even further. Core inflation, which strips out energy and food prices, may be driven higher by the increasing prices for food in the country, analysts warned.

Turkey’s central bank has kept the key interest rate at 19 per cent for three months, but should inflation rise, the central bank, which seems to be under control of the Turkish presidency, is unlikely to react. In fact, there are expectations that the bank will cut interest rates in the near future.

Inflation is up from 15.97 per cent in January and 11.89 per cent in October 2020, leaving a high risk inflation rises above interest rates soon.

Domestic political uncertainty continue to pressure the lira as well. Accusations by mob boss Sedat Peker, in a series of videos, have alleged links between the Turkish government and the Mafia. Peker’s videos, which have been viewed by more than 70 million people, have made accusations of corruption involving a number of government ministers.

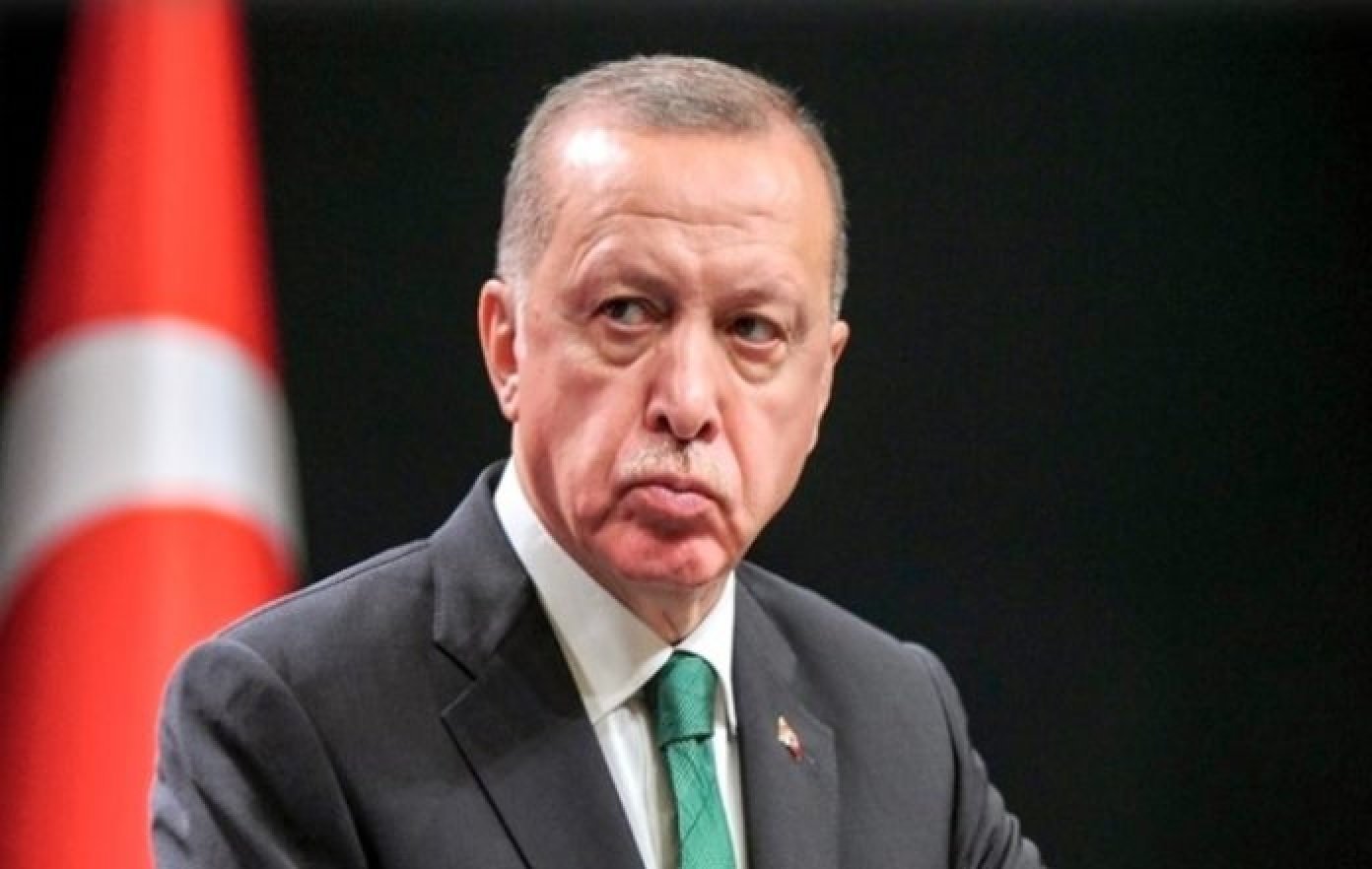

While Turkish President Recep Tayyip Erdogan spoke out on Wednesday in the Turkish parliament against these accusations, and vowed to combat organised crime, his statements have had little or no effect on the Turkish lira’s decline.

Since March, when Erdogan fired Naci Agbal, the central bank governor who had promised to tighten credit and fight inflation, international investor confidence in Turkey has plummeted.

With investors pulling out of emerging market funds, according to Refinitiv Lipper data, Turkey is likely to see a massive withdrawal of foreign investment if the inflation figure, to be announced next week is grim and without any central bank response.

Click here to change your cookie preferences