Elon Musk has won the backing of some of the world’s wealthiest investors for his $44 billion takeover of Twitter Inc (TWTR.N).

From Oracle Corp’s (ORCL.N) co-founder Larry Ellison, a self-proclaimed close friend of Musk, to Saudi Arabian investor Prince Alwaleed bin Talal, who had earlier rejected the takeover bid, a bunch of investors have now thrown their weight behind the offer.

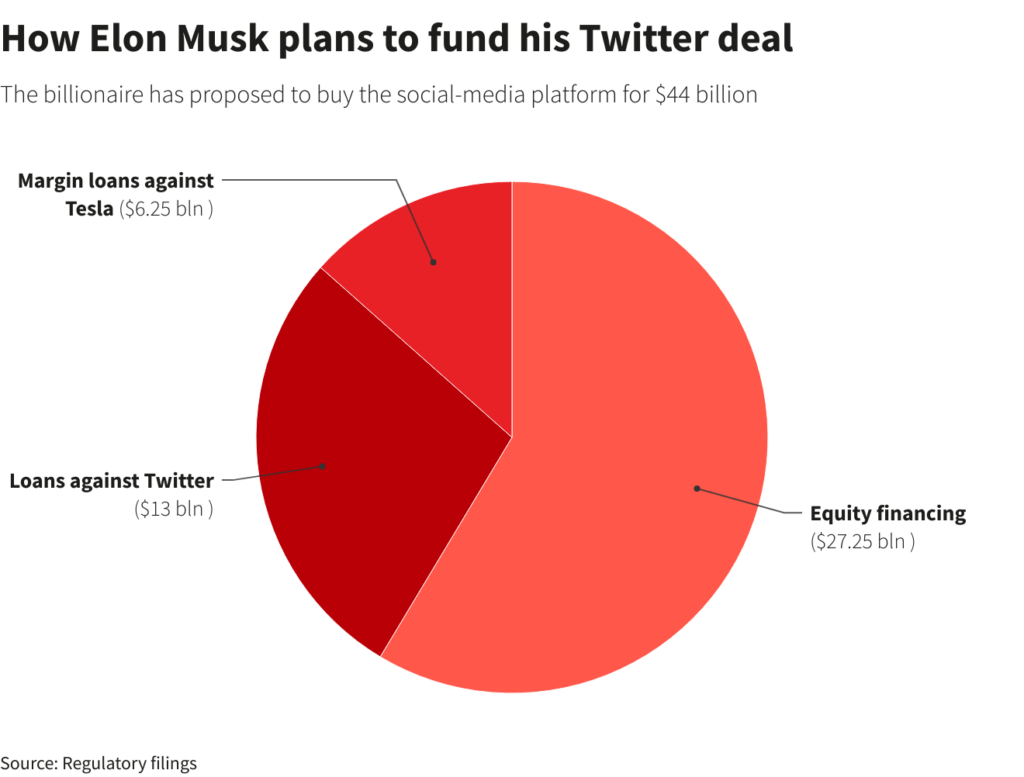

Here’s how the deal stacks up:

** Musk increased his financing commitment to $27.25 billion, from $21 billion – including the new $7.14 billion funding announced on Thursday

** The margin loan from Morgan Stanley tied to his Tesla (TSLA.O) stock stands at $6.25 billion, down from $12.5 billion announced on April 21

** Musk has secured commitments from banks for $13 billion in loans secured against Twitter shares

Following is a list of investors who have together promised about $7 billion in funding, according to a filing on Thursday:

|

Equity Investor

|

Description

|

Equity Commitment

|

|

A.M. Management & Consulting

|

–

|

$25 million

|

|

AH Capital Management

|

VC firm founded by Marc Andreessen and Ben Horowitz

|

$400 million

|

|

Aliya Capital Partners

|

SpaceX investor

|

$360 million

|

|

BAMCO

|

Investment adviser

|

$100 million

|

|

Binance

|

Cryptocurrency firm

|

$500 million

|

|

Brookfield

|

Canadian investment firm with over $690 billion assets under management

|

$250 million

|

|

DFJ Growth IV Partners

|

Tesla, SolarCity, SpaceX and The Boring Company investor

|

$100 million

|

|

Fidelity Management & Research Company

|

Acts as the investment advisor to Fidelity’s family of mutual funds

|

$316 million

|

|

Honeycomb Asset Management

|

Private investment firm led by Chief Investment Officer David Fiszel

|

$5 million

|

|

Key Wealth Advisors

|

$30 million

|

|

|

Lawrence J. Ellison Revocable Trust

|

Oracle co-founder Larry Ellison’s trust

|

$1 billion

|

|

Litani Ventures

|

Chicago-based VC firm

|

$25 million

|

|

Qatar Holding

|

Investment house founded by Qatar Investment Authority

|

$375 million

|

|

Sequoia Capital Fund

|

Invested in The Boring Company

|

$800 million

|

|

Strauss Capital LLC

|

–

|

$150 million

|

|

Tresser Blvd 402 LLC (Cartenna)

|

–

|

$8.5 million

|

|

VyCapital

|

Invested in The Boring Company

|

$700 million

|

|

Witkoff Capital

|

New York-based real estate tycoon Steven Witkoff’s firm

|

$100 million

|

|

Saudi Arabian investor Prince Alwaleed bin Talal

|

Twitter investor

|

$1.89 billion (34,948,975 shares)

|

Click here to change your cookie preferences