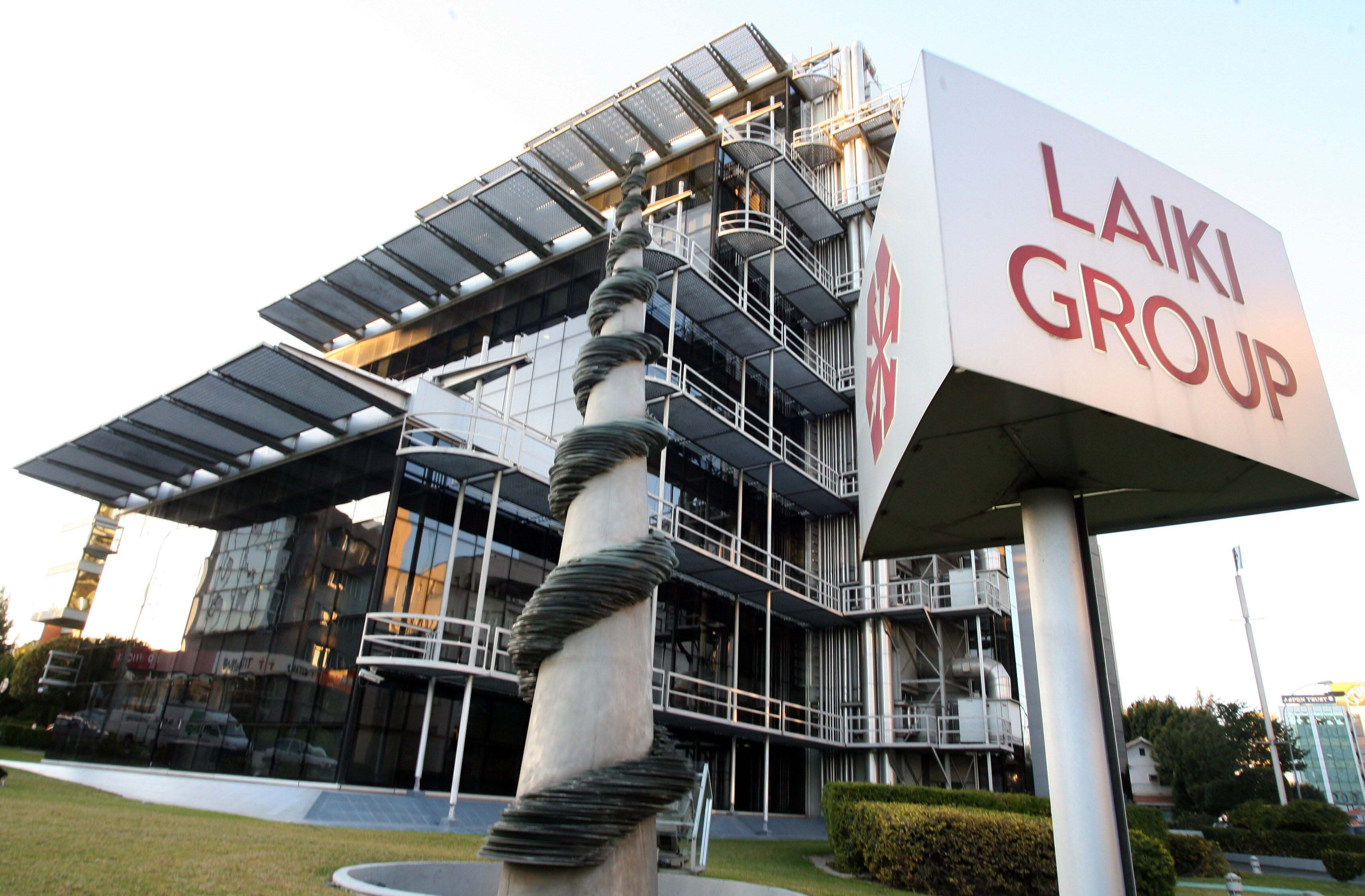

The National Solidarity Fund’s committee agreed on Friday on the structure of a scheme to compensate losses for former Laiki bank depositors, with Sykala – the Laiki Bank Depositors Association – saying on Tuesday that twelve years down the line an “acceptable” result had been reached.

“Twelve and a bit years later, we have managed to reach a result, not according to our absolute aspirations, but acceptable,” Sykala said.

The scheme “is only for 2025 and only for natural persons and imposes a ceiling of €1 million for losses”, Sykala said in a statement.

Each year, it explained, “will have its own scheme”.

According to the scheme for 2025, “the total disbursement amount for all beneficiaries of the first disbursement to be around €100 million and provides for a replenishment rate of 10 per cent on the net loss/impairment/haircut, with a maximum replenishment ceiling of €100,000 [compensation] per beneficiary.”

“Legal entities/companies are expected to be included in later plans when they clarify some details for which the attorney-general’s office was requested to provide an opinion.”

The decision will now be sent to the finance minister, who will in turn present it to the cabinet for approval, after which it will be referred to parliament to release the necessary amount.

Sykala hopes this will all be done before the House summer recess and the beneficiaries will be paid next month.

Burned savers will have to apply online in June, confirming the amounts to be compensated.

The scheme also includes Bank of Cyprus depositors and bondholders.

There are around 13,000 beneficiaries of the scheme.

According to what was heard in parliament recently, verified losses for depositors and bondholders during the 2013 ‘haircut’ tally at €2 billion overall.

Under the bailout programme between Cyprus and its international lenders in March 2013, large depositors paid for the recapitalisation of the Bank of Cyprus, heavily exposed to debt-crippled Greece.

Big savers with the Bank of Cyprus had 47.5 per cent of their uninsured deposits (any amount over €100,000) converted into shares. As for Laiki Bank, all uninsured deposits there were wiped out, and the lender was wound down and its operations folded into the Bank of Cyprus.

Click here to change your cookie preferences