In Cyprus, many small business owners still rely entirely on their accountant for everything related to finances. It’s a long-standing habit – “My accountant handles it” – that often leaves owners disconnected from the actual performance of their business.

Without access to up-to-date numbers, many business decisions are made in the dark. Owners don’t know how much VAT they owe, how much money is coming in or going out, or how much they’ve spent until they receive a quarterly or year-end report. That lack of visibility can limit growth, increase financial risk, and delay critical decisions.

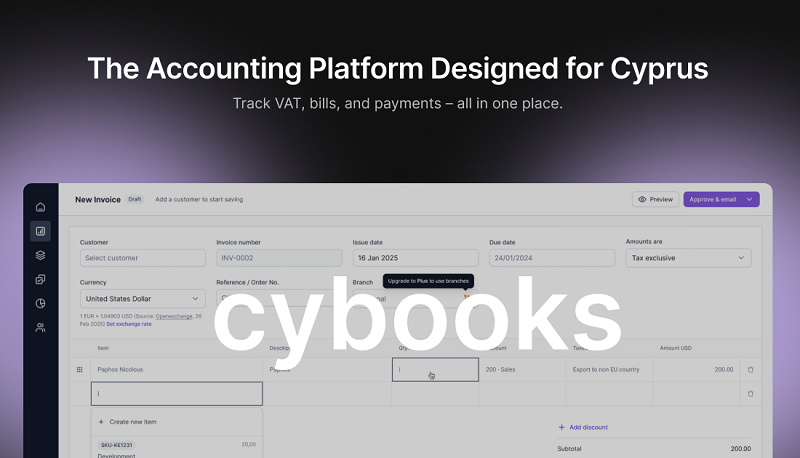

Cybooks, a modern cloud-based accounting platform built in and for Cyprus, is changing that dynamic.

Unlike international tools like Xero or QuickBooks, Cybooks is designed specifically for the Cypriot business environment. It supports automated VAT return preparation, VIES reporting, and includes upcoming payroll features aligned with local requirements such as GESY, social insurance and income tax.

It also connects directly to local banks including Hellenic Bank, Bank of Cyprus, and even Revolut, allowing business owners to automatically import and reconcile their bank transactions without manual uploads or outdated spreadsheets.

“Cybooks doesn’t replace your accountant – it makes your accountant part of your system,” says co-founder Christopher Dosin. “You finally get access to your own numbers, in real time, without waiting for someone else to interpret them.”

One of the biggest benefits for business owners is the ability to work directly inside the same platform as their accountant. With shared access and flexible permissions, business owners can see exactly what’s happening – whether it’s tracking revenue, reviewing expenses, or preparing for tax time – while their accountant handles filings, reports and compliance.

Cybooks also tackles a common administrative burden: manual data entry. Its intelligent document extraction feature allows users to upload receipts and bills by photo or PDF, and automatically extracts all key data with over 90 per cent accuracy. Supplier names, dates, VAT amounts, and even line items are digitised and ready to reconcile in seconds.

VAT and VIES compliance, which are often last-minute headaches for businesses, are also streamlined. Cybooks keeps these obligations visible throughout the month, so users are never caught off guard by a sudden payment or missed submission. Transactions with EU partners are automatically flagged and prepared for inclusion in VIES reports.

And with a local payroll module on the way, Cybooks aims to become the most complete accounting solution available to Cypriot businesses – handling everything from payslips to government contributions in one integrated workflow.

Because it’s cloud-based, Cybooks doesn’t require installation or technical setup. Business owners can log in anytime, from anywhere, and view their latest financial position on a clean, easy-to-use dashboard.

“We built Cybooks to give business owners clarity and control,” says Dosin. “When you know your numbers, you make better decisions – and better decisions grow businesses.”

Cybooks is available on a monthly subscription, with a free trial for new users.

Click here to change your cookie preferences