Investors are again weighing risk and reward as crypto prices shift daily. Some prefer long-standing names like XRP, known for its focus on payments. Others are moving toward new DeFi projects with fresh ideas and low entry costs. Mutuum Finance (MUTM) is one of those newer names. It is trending among traders searching for the next crypto to explode because it combines utility, growth, and accessibility. This article looks at both assets to see which one might offer better balance for a modern crypto portfolio.

Mutuum Finance (MUTM) is now in Phase 6 of its presale, with each token priced at $0.035. About 80% of the 170 million tokens in this phase are already sold. The project has raised around $18 million across all phases, and more than 17,500 holders are already on board. The total token supply stands at 4 billion MUTM. When Phase 7 begins, the price will rise to $0.040 — an increase of 15%. That makes this phase the final low-cost entry before the price climbs again.

XRP: Steady performer with limited upside

XRP is a well-known project in the payments sector. It focuses on fast cross-border transfers and remains one of the most liquid digital assets. Institutional adoption and steady on-chain usage support its long-term relevance. Still, its growth pace has slowed compared to earlier years.

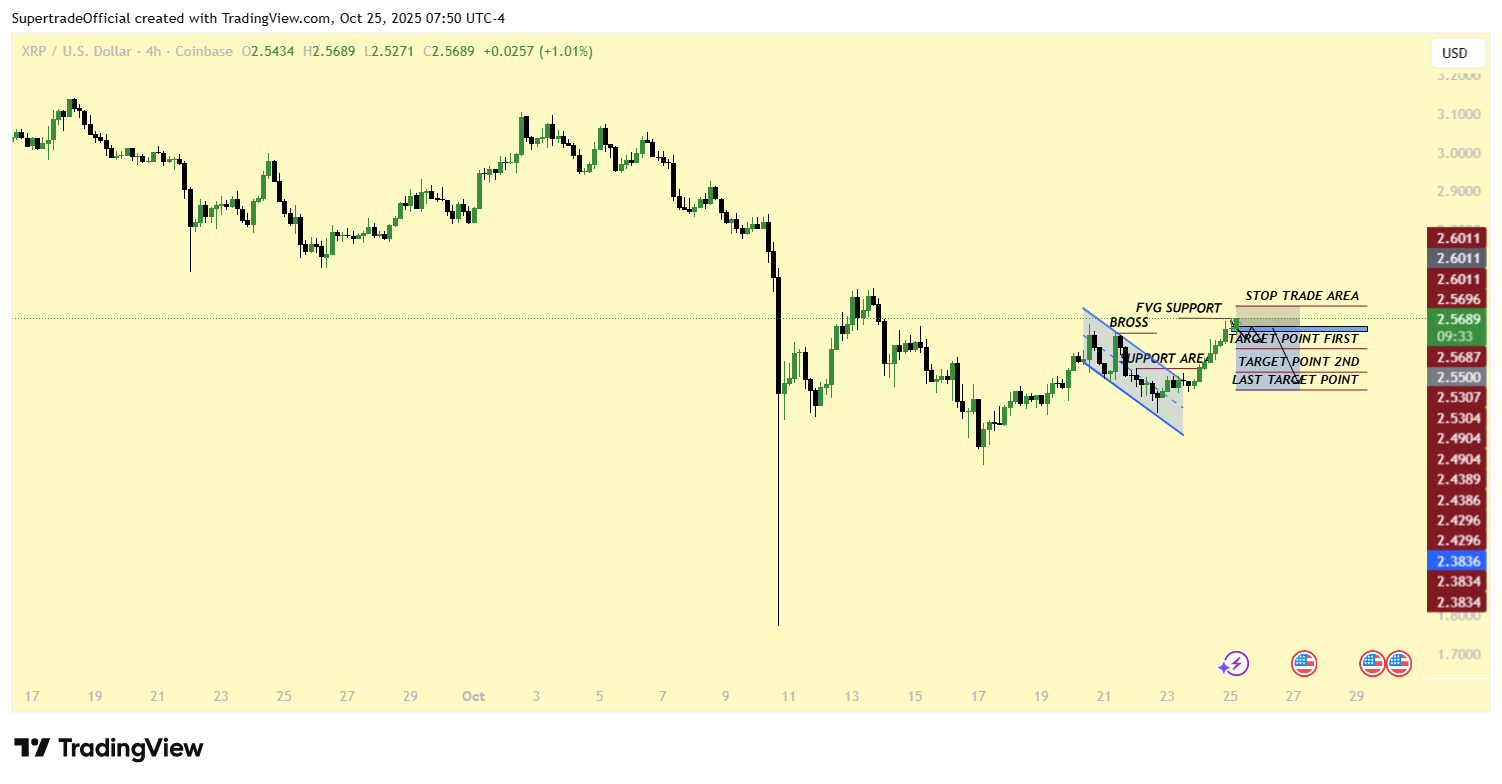

The analysis identifies an entry zone between 2.545 and 2.550, positioned near a fair value gap (FVG) resistance level where sellers may regain control. A break above 2.568 would invalidate the setup, signaling that the bearish structure has failed and the trade should be closed. Price targets are defined in three stages: the first target lies between 2.530 and 2.490, representing the initial profit-taking zone. The second target extends to 2.438–2.430, where stronger support is expected to form. The final target is set at 2.383, aligning with a deeper liquidity zone where buyers may begin to re-enter.

While this return is solid, it’s modest compared to newer tokens entering the market. XRP’s risks mainly lie in regulatory updates and occasional liquidity swings during broader market pullbacks. These factors keep XRP suitable for investors seeking stability, but it may not be the next crypto to explode.

MUTM: Utility-Focused token with expanding use

Mutuum Finance (MUTM) is building a DeFi platform designed for real activity — lending, borrowing, and staking. As per the X team, the first version of the protocol will be launched on Sepolia Testnet planned for Q4 2025, featuring a Liquidity Pool, mtToken, Debt Token, and Liquidator Bot. ETH and USDT will be the first assets for lending/borrowing and collateral testing. These core tools are what make the project stand out.

A conservative listing target for MUTM is $0.06. Post-listing, a realistic price range between $0.20 and $0.30 is expected, representing around a 3.3× to 5× jump from the listing price. This growth projection is supported by product use, buy-and-distribute rewards, and steady staking demand.

Mutuum’s Peer-to-Contract model allows users to lend or borrow with ease. A lender depositing $20,000 worth of BTC into an mtBTC pool will receive mtBTC tokens. With a 12% annual yield, that deposit is expected to earn about $2,400 each year. On the borrowing side, a user locking $1,000 worth of AVAX as collateral will be able to borrow up to $700 while keeping exposure to AVAX’s market movement.

The platform will also run a Peer-to-Peer model for less-liquid tokens such as meme coins. These loans will offer higher returns but remain isolated from the main pools to protect liquidity. Together, both systems will drive repeat transactions and demand for MUTM tokens.

An investor example shows the difference between traditional and new approaches. A user who swapped $7,500 worth of ETH into Mutuum Finance (MUTM) during Phase 1 at $0.01 received 750,000 tokens. At today’s price of $0.035, that holding is valued at $26,250, showing a 3.5× rise. At the planned listing price of $0.06, the value reaches $45,000, or 6×. With a conservative post-listing target of $0.25, the same holding will be worth $187,500 — around 25× from the original entry.

MUTM buybacks fueling demand and community growth incentives

Mutuum Finance (MUTM) also has a buy-and-distribute system that strengthens demand. A share of platform revenue will repurchase MUTM from the open market and distribute it to mtToken stakers. This design creates continuous buying activity and rewards users for long-term participation. This will regularly increase MUTM demand and hence the demand will go up appreciating the pricing over time.

The platform’s community tools make participation fun and rewarding. A 24-hour leaderboard is already live, rewarding the top trader each day with $500 in MUTM, provided they make at least one transaction in that period. The dashboard and leaderboard help build user engagement and keep the community active.

Mutuum also applies strong risk controls. Loans will stay overcollateralized, and liquidation systems will protect both lenders and borrowers. Stable assets will have loan-to-value ratios up to 80%, supported by reserve factors that maintain platform stability even during a crypto crash.

In a balanced portfolio, XRP serves as the stable core, offering predictable returns. Mutuum Finance (MUTM) brings higher risk but also higher reward. With a conservative post-listing range of $0.20–$0.30 and strong demand mechanics, it represents meaningful upside. Phase 6 is already 80% sold, and the next phase will raise the price to $0.040. For investors who want a calculated position that tilts their portfolio toward stronger gains, MUTM’s last presale window is closing — and history rewards early, strategic moves.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER – “Views Expressed Disclaimer – The information provided in this content is intended for general informational purposes only and should not be considered financial, investment, legal, tax, or health advice, nor relied upon as a substitute for professional guidance tailored to your personal circumstances. The opinions expressed are solely those of the author and do not necessarily represent the views of any other individual, organization, agency, employer, or company, including NEO CYMED PUBLISHING LIMITED (operating under the name Cyprus-Mail).

Click here to change your cookie preferences