Cyprus continues to offer relatively cheaper borrowing for households, particularly for housing, while delivering the lowest deposit returns in the euro area, according to the European Central Bank (ECB).

The ECB’s latest interest rate figures for November 2025 cover loans and deposits across the euro area, shedding light on borrowing and savings conditions and highlighting Cyprus’ position relative to its peers at a time of easing credit conditions and persistently weak deposit returns.

Bank interest rates on loans reflect the rates applied by monetary financial institutions to euro-denominated loans issued to households and corporations resident in euro area countries, offering a snapshot of the cost of credit across the bloc.

In November 2025, the average euro area cost of borrowing for households for consumption stood at 7.33 per cent, remaining steady compared with the previous month.

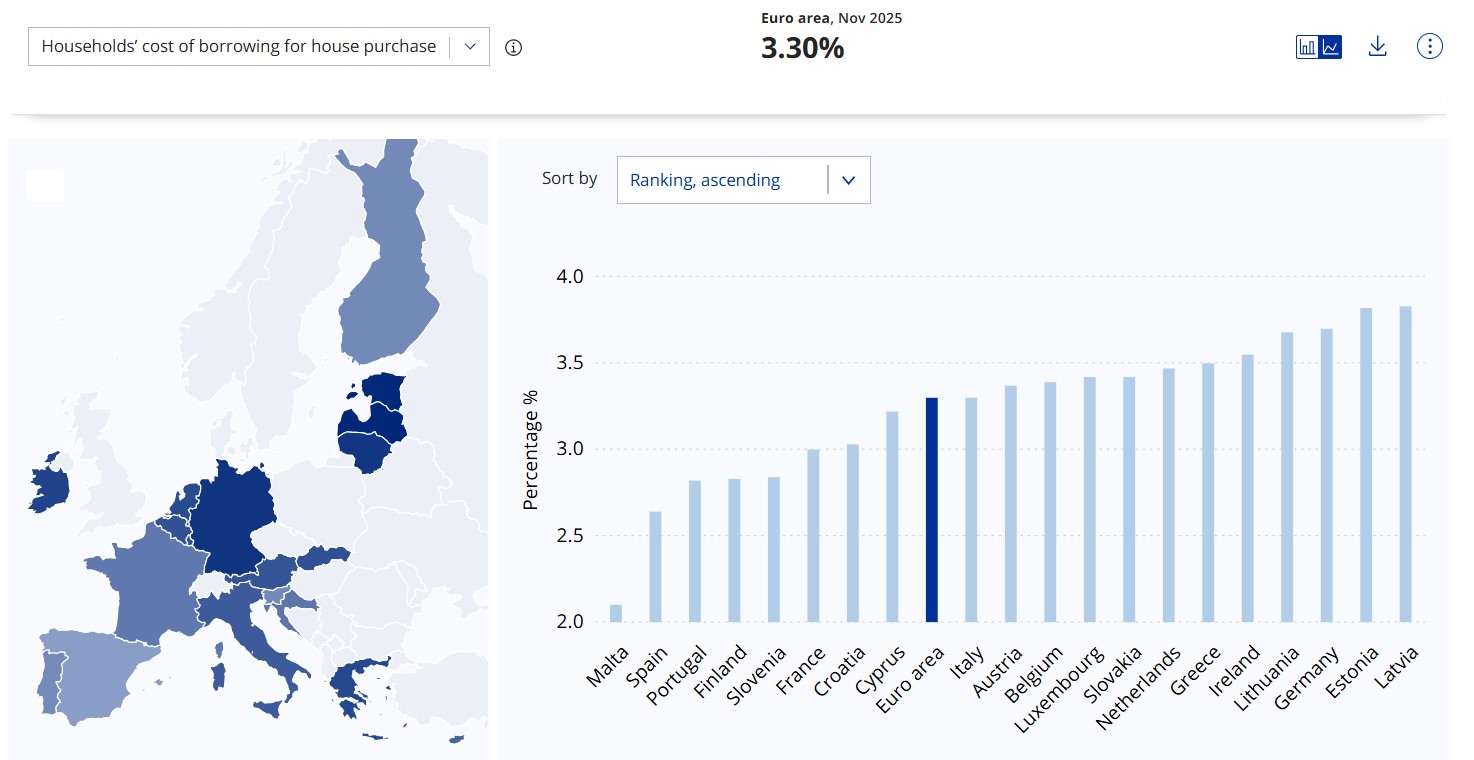

The average euro area cost of borrowing for households for house purchase was 3.3 per cent in November 2025, also unchanged on a monthly basis.

For businesses, the average euro area cost of borrowing for corporations declined to 3.4 per cent in November 2025, marking a downward movement.

In Cyprus, the cost of borrowing for households for consumption reached 6.2 per cent in November 2025, remaining below the euro area average.

The Cyprus cost of borrowing for households for house purchase stood at 3 per cent in November 2025, undercutting the euro area average of 3.3 per cent.

By contrast, the cost of borrowing for corporations in Cyprus was higher, standing at 4.29 per cent in November 2025.

The composite cost of borrowing, measured by household borrowing costs for house purchase, came in at 3.3 per cent in the euro area and 3.2 per cent in Cyprus in November 2025, confirming Cyprus’ slightly more favourable position in housing finance.

On the savings side, bank interest rates on deposits cover the rates applied by monetary financial institutions to euro-denominated deposits held by households and corporations across the euro area.

Across the euro area in November 2025, interest rates on household overnight deposits stood at 0.25 per cent, remaining steady.

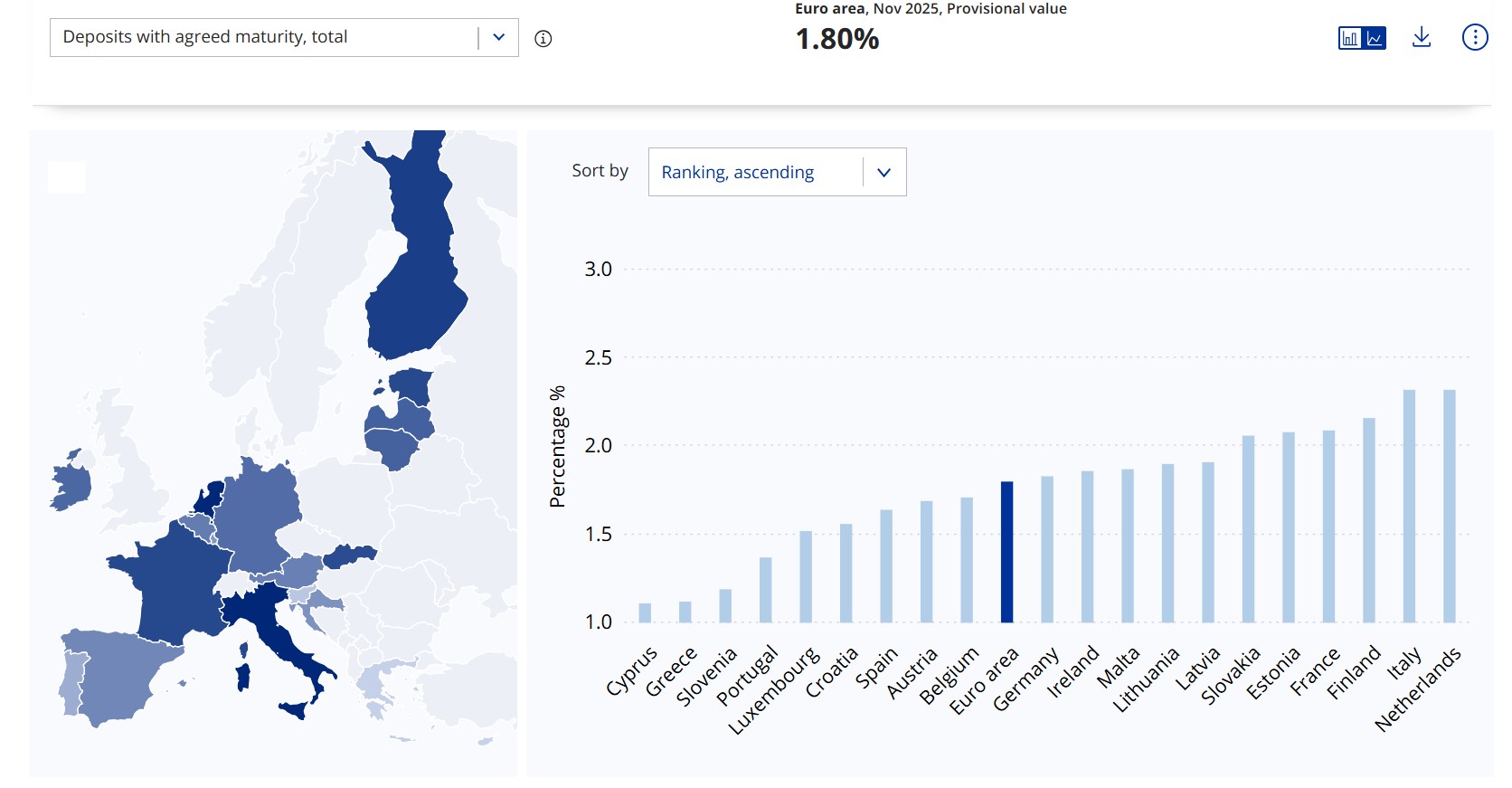

Interest rates on household deposits with agreed maturity in the euro area averaged 1.8 per cent, unchanged from the previous month.

For businesses, corporate overnight deposit rates in the euro area fell to 0.52 per cent in November 2025.

At the same time, corporate deposits with agreed maturity in the euro area increased to 1.93 per cent.

In Cyprus, household overnight deposit interest rates were 0.00 per cent in November 2025, the lowest in the euro area.

The total interest rate on household deposits with agreed maturity in Cyprus stood at 1.1 per cent, also the lowest in the euro area.

For household deposits with maturity of up to 1 year, Cyprus recorded an interest rate of 1.13 per cent in November 2025, making it the third lowest in the euro area.

This places Cyprus only above Slovenia at 0.79 per cent and Greece at 1.12 per cent, and well below the euro area average of 1.75 per cent.

Interest rates on household deposits with maturity between a minimum of 1 year and a maximum of 2 years in Cyprus fell to 0.69 per cent, the lowest in the euro area, compared with a bloc-wide average of 1.97 per cent.

For corporations in 2025, overnight deposit interest rates in Cyprus stood at 0.02 per cent, sharply below the euro area average of 0.52 per cent, making Cyprus the lowest in the euro area.

Similarly, corporate deposits with agreed maturity in Cyprus averaged 0.89 per cent in 2025, again the lowest in the euro area, compared with an average of 1.93 per cent across the bloc.

Taken together, the ECB data show that while borrowing costs for Cypriot households, particularly for housing, remain slightly more favourable than the euro area average, depositors in Cyprus continue to face the weakest returns in the euro area, underscoring a persistent imbalance between lending and savings conditions.

Click here to change your cookie preferences