Depositors and bondholders who saw their savings wiped out in the 2013 bank bail-in conveyed on Tuesday their strong dissatisfaction with the terms of a compensation scheme, asking to meet the finance minister in person by week’s end.

The burned savers want to see Finance Minister Makis Keravnos to stress their disagreement with the method of calculating upcoming disbursements of compensation, which they call unfair.

A main gripe is that the government has capped compensation at €25,000 per beneficiary. And each beneficiary is entitled to 15 per cent of their losses in the 2013 crash.

There are around 13,000 beneficiaries of the scheme.

Under the schedule, disbursements of moneys are slated to begin in June. According to reports, some €100 million will be distributed this year to beneficiaries – out of the total €260 million available funds in the Solidarity Fund.

According to what was heard in parliament recently, verified losses for depositors and bondholders during the 2013 ‘haircut’ tally at €2 billion overall.

Under the bailout programme between Cyprus and its international lenders in March 2013, large depositors paid for the recapitalisation of the Bank of Cyprus, heavily exposed to debt-crippled Greece.

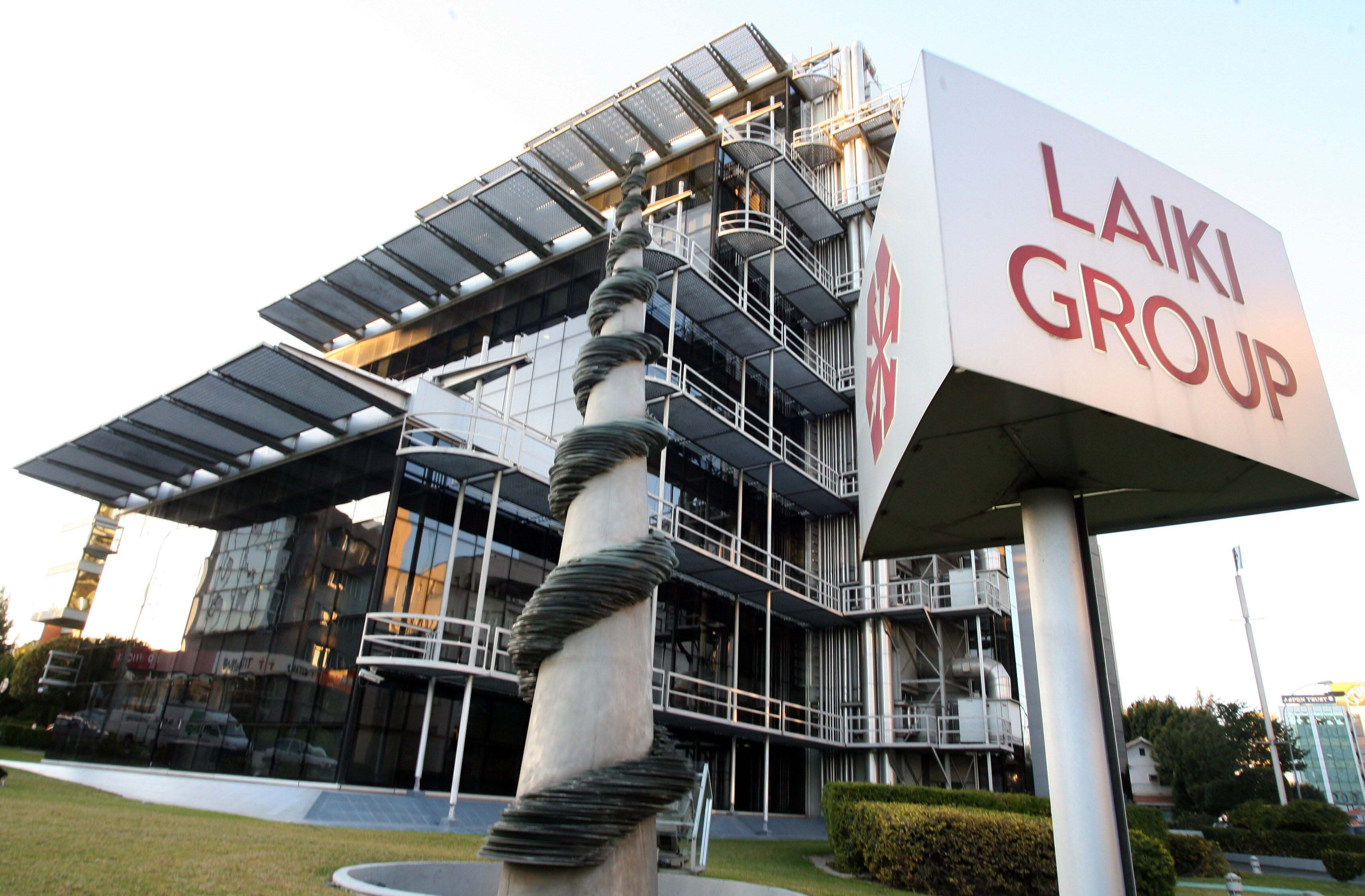

Big savers with the Bank of Cyprus had 47.5 per cent of their uninsured deposits (any amount over €100,000) converted into shares. As for Laiki Bank, all uninsured deposits there were wiped out, and the lender was wound down and its operations folded into the Bank of Cyprus.

Head of the association of Laiki Bank depositors (Sykala) Adonis Papaconstantinou told the Stockwatch news outlet that they “disagree completely with the philosophy of the disbursement plan”.

He pointed out that Laiki depositors suffered the worst. As for Bank of Cyprus savers, they saw their uninsured deposits shaved by 47.5 per cent, but the shares they got mitigated the actual loss to about 36 per cent.

Head of the bondholders association (Sykata) Stavros Yiallourides described as “unfair” the ceiling of 15 per cent for compensation. This would satisfy those who held savings of up to €170,000.

He also recalled that whereas dozens of bondholders took to the courts and got a favourable decision, they have yet to receive compensation because, under the relevant Companies Law, the liquidation of Laiki Bank needs to be completed first.

The statute of limitations for filing a civil lawsuit (for example against Bank of Cyprus) is six years. That means that the last bail-in lawsuits against banks were filed in 2019 – six years after the fact.

Click here to change your cookie preferences