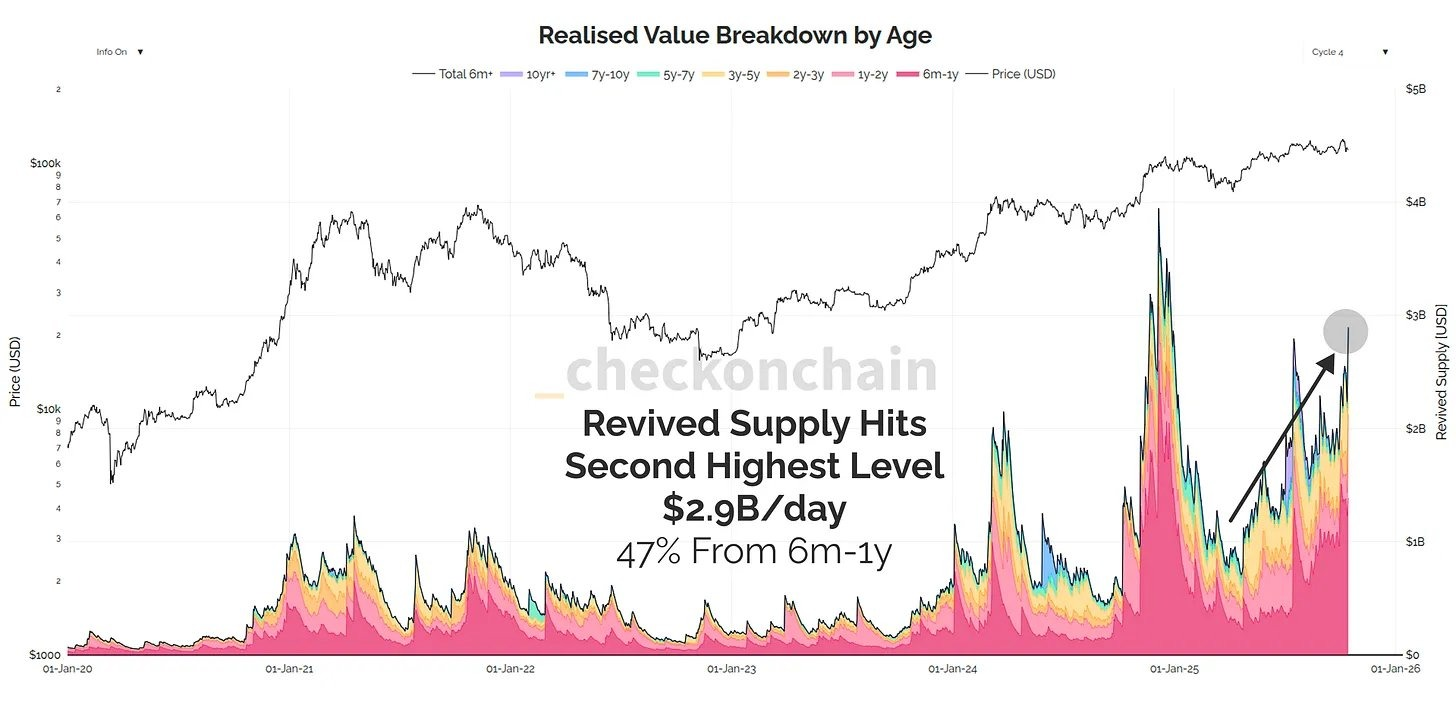

Long-term Bitcoin holders have unloaded positions at unprecedented rates, realizing $1.7 billion in daily profits while $2.9 billion in older coins re-enters circulation. Analysts like James Check have noted this sell-side pressure as the main resistance capping price recovery.

Will Clemente observed transfers from original gangsters to traditional finance players over the past year. Mike Novogratz highlighted friends cashing out for yachts and sports team stakes after years of holding.

Yet, these moves signal a shift. Bitcoin enthusiasts now seek diversified gains through altcoins, particularly defi cryptos offering yield without full exits. Mutuum Finance (MUTM) has emerged as the best crypto to buy now for such strategies, blending lending utility with presale momentum.

Holders eye 371% potential returns post-launch at $0.06, far beyond Bitcoin’s current stall.

Bitcoin holders capitalize on peaks

Veteran Bitcoin investors have accelerated profit-taking, pushing realized gains to cycle highs. Check’s charts revealed spent coins averaging older ages, confirming original holders drive the volume.

Clemente pointed to on-chain data showing supply shifts to institutional buyers, easing future weakness. Novogratz shared anecdotes of peers diversifying into real-world assets after prolonged rides. This unloading creates a pause, yet it frees capital for altcoin plays.

Enthusiasts recognize the best crypto to buy now lies in defi cryptos like MUTM, where idle Bitcoin can collateralize loans for steady yields. Such stacking preserves upside while generating income, turning sell-off fatigue into proactive gains.

Mutuum Finance gains traction

Mutuum Finance (MUTM) has drawn Bitcoin loyalists seeking the top crypto for diversification. The project has raised $17,750,000 since presale inception, onboarding 17,340 holders. Phase 6 now unfolds at $0.035 per token, a 250% rise from phase one’s $0.01 entry.

Yet urgency mounts; 70% of this phase has filled, with sell-out imminent. Investors scramble for this final window before phase 7 hikes prices 14.3% to $0.04. The team finalized its Certik audit, scoring 90/100 on token security.

Lending protocol advances

Developers at Mutuum Finance announced progress on its lending and borrowing protocol. Version 1 deploys to Sepolia Testnet in Q4 2025, featuring liquidity pools, mtTokens, debt tokens, and liquidator bots. Initial support targets ETH and USDT for lending, borrowing, and collateral.

Borrowers overcollateralize positions, with loan-to-value ratios capping exposure—75% for stable assets like ETH. Liquidation triggers activate at 80% thresholds, offering bonuses to liquidators for swift resolutions. Interest rates adjust via utilization, staying low during abundance to spur borrowing, then rising to draw deposits amid scarcity.

Stable rate options lock predictability, starting higher but rebalancing if variables surge beyond 90% margins. These mechanics ensure solvency, drawing Bitcoin holders to defi crypto yields.

Presale incentives surge

Mutuum Finance rolled out a dashboard tracking top 50 holders, including a 24-hour leaderboard resetting at 00:00 UTC. The daily leader claims a $500 MUTM bonus after one transaction. Recent frontrunners posted buys of $7,036.48 and $6,619.13 in the last day.

Meanwhile, the project unveiled its largest giveaway: $100,000 in MUTM split among 10 winners at $10,000 each. Participants submit wallet addresses, complete quests, and invest at least $50 in presale to qualify.

This blend of utility and rewards positions MUTM as the best crypto to buy now, outshining stagnant altcoins. Bitcoin enthusiasts stack here for overcollateralized loans yielding real returns, not mere speculation.

Altcoin stacking unlocks yields

Bitcoin’s veteran sellers have pivoted to altcoins like MUTM for DeFi crypto edges. Early buyers stand to gain 371% from current levels post-launch. The protocol’s dual markets, peer-to-contract pools for instant access and peer-to-peer for custom terms, cater to varied needs.

Lenders earn via mtTokens accruing interest, redeemable anytime. Borrowers unlock liquidity against holdings, repaying to reclaim collateral seamlessly. Deposit and borrow caps limit risks, while reserve factors buffer volatility, 10% for stables, up to 35% for others.

Chainlink oracles feed prices, with fallbacks for resilience. This setup eclipses Bitcoin’s hold-and-wait, delivering diversified gains through active utility. Join the presale before phase 6 vanishes; secure your position today.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER – “Views Expressed Disclaimer – The information provided in this content is intended for general informational purposes only and should not be considered financial, investment, legal, tax, or health advice, nor relied upon as a substitute for professional guidance tailored to your personal circumstances. The opinions expressed are solely those of the author and do not necessarily represent the views of any other individual, organization, agency, employer, or company, including NEO CYMED PUBLISHING LIMITED (operating under the name Cyprus-Mail).

Click here to change your cookie preferences