The Paphos regional board of tourism (Etap) this week announced that it participated in the inaugural meeting for the U-Mar Project, in Sicily, as part of the actions of the European Union’s ERASMUS + programme.

According to an announcement, the project partners met on March 30, exchanging views on their future actions and informing each other about the project and its innovative aspects.

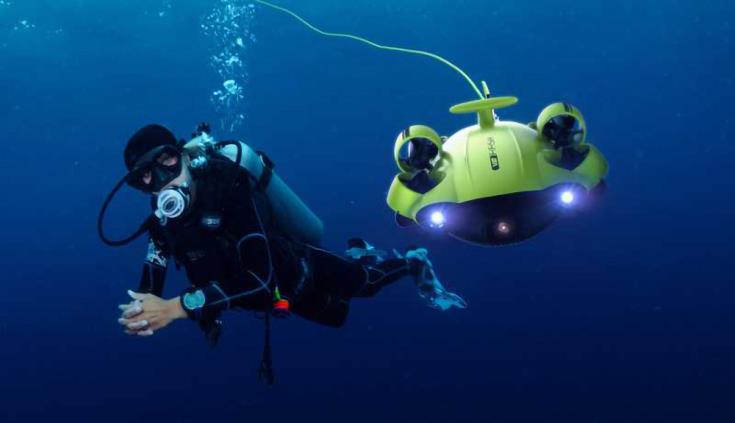

The project, the statement added, will address issues regarding the strengthening of underwater archaeology, thought to be an innovative tool for the development of sustainable and creative tourism.

Apart from Cyprus, other partners came from Spain, Italy, Portugal and Croatia.

The project is expected to absorb €300,000 in total, while it will have a two-year duration, with Etap Paphos’ actions amounting to €40,000.

For the ETAP Paphos, the approval of this proposal is an important development, since the promotion and development of Cypriot Marine archaeology are still in their preliminary stages, but with a wide scope for action.

The programme will allow people to receive training on the subject, enabling them to study international best practices and explore opportunities for the promotion and stimulation of underwater archaeological sites in a more responsible and sustainable way.

The board anticipates that marine archaeology can become another important source of tourism for Paphos in the coming years.

The Cabinet of Ministers on Thursday approved a proposal by Minister of Finance Constantinos Petrides for the issuance by the Republic of Cyprus of a green bond.

The Minister of Finance has received authorisation to proceed with all the necessary preparations for the implementation of the proposal.

“Green bonds are a financial tool that attracts special interest from international investors and its use by the Republic of Cyprus will offer multiple advantages, as it will offer access to new investors and increase the interest in international capital markets, expanding the state’s financial choices,” the Ministry of Finance said in a statement.

The ministry explained that promoting this financial tool “indicates the will and commitment of the state in environmental and social issues and is an integral part of the effort to transition to a green economy”.

The Cyprus Stock Exchange (CSE) announced this week that it has signed an agreement with Harneys Loizou Armila Shearman Consortium, designating them as the consultants tasked with the preparation of a business plan for the Cyprus Stock Exchange.

The consortium will also be tasked with handling all legal issues and actions regarding the selection of the most suitable strategic partner and investor for the Cyprus Stock Exchange.

The CSE said in a statement that its board concluded the above agreement following an open tender process, before evaluating the resulting offers from all interested parties.

The statement added that the tender of the above consortium was evaluated as the most financially prudent, based on the best price-quality criteria, in accordance with the terms of the tender procedure.

Moreover, the CSE said that this effort is part of the broader strategic plan for the privatisation of the stock exchange, following a relevant decision by the cabinet of ministers.

The project, according to the terms of the tender, is expected to be completed within 14 months from the signing of the agreement, with a maximum transitional period of 9 months.

According to the CSE statement, the privatisation terms include “the selection of a strategic partner and investor, who will be a reputable stock exchange providing added value to the CSE, so that the stock market in Cyprus can be further developed, contributing substantially to the further development of the enterprises and the economy”.

Finally, the CSE said that through the implementation of this plan, the organisation will become more flexible, acquire additional know-how, and become more adaptable to the changing conditions in stock markets, taking advantage of new opportunities and developments.

The Cyprus Investment Funds Association (CIFA) on Thursday said that the investment funds sector has become a new source of growth for the Cypriot economy, with both the total value of assets under management and licensed entities growing impressively during the previous year.

“Despite the challenges, 2021 has been another successful year for the Investment Funds sector in Cyprus,” CIFA said in a statement, referencing the data published by the Cyprus Securities and Exchange Commission (CySEC) that show a strong, but also steady, increase in the size of the sector.

The CySEC data showed that the total Assets Under Management (AUM) by the Investment Funds based in Cyprus reached €11.6 billion at the end of December 2021, compared to €8.6 billion at the end of 2020, reflecting an increase of 34.8 per cent.

In terms of the number of regulated Management Companies and Undertakings of Collective Investments, these reached 310 during the fourth quarter of 2021, of which 224 already have activities in Cyprus.

This was the first time regulated companies of this kind surpassed 300 in number.

In 2020, the same figure stood at 283, of which 197 had activities, while a number of new applications for licensing are currently being evaluated by CySEC.

CIFA also noted that an equally positive development is the fact that the funds invested by the Investment Funds in the Cypriot economy have also grown in number, with the total AuM invested in the Cypriot economy at the end of 2021 reaching €2.6 billion, an increase of 18 per cent year-on-year.

The Cyprus Investment Funds Association (CIFA) believes that the growth observed in recent years, even under pandemic conditions and high uncertainty, has now established the Investment Fund sector as one of the fastest-growing in the Cypriot economy, which creates significant benefits for other sectors and the workforce,” the association said, stating that the sector is very dynamic and competitive.

“Under these conditions, Cyprus can compete equally with other European destinations and can continue to attract Funds and Administrators from around the world,” CIFA concluded.

The Cyprus Stock Exchange (CSE) ended Thursday, April 7 with negligible profits.

The main Cyprus Stock Market Index was at 67.56 points at 13:12 during the day, reflecting a rise of 0.01 per cent over the previous day of trading.

The FTSE / CySE 20 Index was at 40.62 points, remaining stable from the day before.

The total value of transactions came up to €41,753.

In terms of the sub-indexes, the main index fell by 0.12 per cent, while the alternative index rose by 0.17 per cent.

The hotel and investment firm indexes remained stable.

The biggest investment interest was attracted by Vassiliko Cement Works (+0.71 per cent), the Bank of Cyprus (+0.21 per cent), the Cyprus Cement Company (no change), Atlantic Insurance (+0.53 per cent), and Logicom (-1.01 per cent).

Click here to change your cookie preferences